M3's Knowledge centre

Keeping up to date is important, so here's the news.

Here is a scenario that plays out far more often than most people realise. A man remarries after a divorce.

At some point, most Australian families confront one of retirement’s most complex financial decisions: how to fund residential aged care.

Dementia feels very different up close than it does in abstract statistics or policy papers.

For many Australians, the housing market does not just feel expensive – it feels frag‑ ile.

When it comes to investing, advice (both good and bad) is never in short supply. But you'll find this simple idea forms the cornerstone of smart investing.

Here’s how to build a sustainable savings system that’s simple, realistic and easy to follow.

If you’re nearing retirement, you might want to learn about this helpful cash injection.

Where should you draw the line when supporting adult kids?

The prospect redundancy can be stressful, but there’s one strategy that can help you bounce back.

Many Australian parents are on track to leave far more to their children than they themselves received, as an estimated A$5.4 trillion of wealth passes between generations over coming decades.

At the age of 95, Warren Buffett stands as an unmatched figure in the world of invest- ment—a “flawed genius” whose wisdom, resilience, and humility continue to shape financial strategies and client outcomes well beyond his formal retirement.

The job market is competitive, and standing out takes more than just a polished resume.

Worried you’re underinsured, overpaying, or stuck with outdated cover that no longer suits you?

If you or your children are hoping to buy property, you’ll need to have a clear idea of what you’re getting into.

Whether retirement is years away or just around the corner, it's good to have a vision of what yours will actually look like.

The Australian commercial property market is experiencing a pivotal moment, propelled by shifting macroeconomic conditions and an influx of institutional and retail investor confidence.

Many financial advisers believe that setting up a ‘Self-Managed Super Fund’ (hereafter referred to as SMSF) is one of the most tax effective and efficient ways of saving for your retirement.

What is gearing? The obvious answer is, to borrow and buy an investment.

This eBook will provide you with useful information on Testamentary Trusts, outlining both the advantages and disadvantages of this financial instrument.

To put it bluntly, Baby Boomers need to help their kids get into the property market. Without that help, the maths doesn’t work and they will not be able to do it. It’s as simple as that

They say that ignorance is bliss, but when it comes to superannuation it pays to know more rather than less.

We are all familiar with the cliché that states there are only two certainties in life namely death and taxes.

One of the most significant trends in the world of property investment at the moment is the growing use of Self-Managed Super Funds (hereafter referred to as SMSF’s) as vehicles with which to buy property.

Granny flats are increasingly being constructed in Australian backyards. There are a number of reasons for this trend.

We classify high net worth individuals as those having investments worth at least $5 million, in addition to the family home. If you are in this position, the typical financial goals of the average Australian such as paying off your mortgage, having money to raise a family and enough superannuation for a comfortable retirement are boxes you have no doubt already ticked.

Life has certainly become much more complex in the area of financial planning over the past few decades but this is, as we shall see, not necessarily a bad thing.

A ‘discretionary trust’ (more commonly known as a ‘family trust’) can be a very useful and powerful tool in the pursuit of long term wealth generation and maintenance.

There are many potential uncertainties when it comes to private education. Parents will typically spend hours discussing whether this is the right option for their children and, if so, which schools to consider.

It is fair to say that anyone who is serious about long term wealth creation would consider gearing as an integral part of their strategy.

There is an old saying that there are only two things that are certain namely death and taxes.

The purpose of this eBook is to provide information to help you understand salary packaging.

A wise man once said: “Those who aim at nothing hit it every time!” This certainly also applies to the world of personal finance.

If there is one constant in the world of taxation and superannuation it is change! A significant change over the past few years has to do with the rates at which those who are assessed as high income earners by the Australian Taxation Office (Tax Office) have to pay tax on superannuation contributions.

A mortgage is very likely the biggest financial commitment you will ever make. How many times have you heard someone say, ‘We don’t actually own our home –the bank does!’

There are a number of trends that will affect when you’ll be able to retire in Australia, as well as how you’ll spend your retirement.

Let’s be honest: You are probably not in teaching for the money! If you are like most teachers, you entered the profession because you have a passion for impacting lives and making a difference in the community.

Share schemes have traditionally been seen as one of the most important ‘weapons’ in the attraction and retention of quality staff.

We have all heard the old saying about death and taxes being the only two certainties in life. That may indeed be the case, what should be added is that you should make sure that you are not taxed to death!

One of the most significant stories in the world of personal finance over the past decade or so was the rise and rise of Self-Managed Super Funds (SMSFs).

The residential property market for an estimated 28,000 of the more than 400,000 participants in the National Disability Insurance Scheme (NDIS) is chronically under-supplied, with around 12,000 of those participants in urgent need of more suitable accommodation.

Perhaps it is the effects of the global credit crunch and the perception that Australia is better placed than most other countries to ride it out.

Rentvesting is the strategy of renting at the same time as investing in an investment property.

Should I buy or rent a home? The answer is not so clear cut: Especially when you look at the matter purely from an investment perspective.

Many Australians have a significant amount of wealth tied up in their family home when it's time to move into aged care—not to mention many precious memories.

Knowledge is power, and in the case of property investing, it can also mean success.

Moving between countries can be a difficult and daunting experience, but many people cope with the initial phases of culture shock by reminding themselves that they made the move in order to secure a better future for themselves and their children.

Wanted: debt-free, risk-averse saver seeks fiscally responsible soul mate for long term, economically stable union.

A discussion paper which challenges the conventional wisdom: the “long only” approach to investing may be putting retirement savings at risk.

When world financial markets are approaching panic mode, many investors and consumers feel they should take immediate action.

Insurance. The very mention of the word is enough to give some people a headache. Our first response to the need for insurance is “That won’t happen to me”.

How do you feel when you think about your financial prospects? Do you feel dread when you think about the future and the state of your finances? Are you uncertain of how you’ll be able to afford the life you want, and provide for your family?

More and more investors are becoming aware of the benefits that can be gained through channelling their retirement savings into Self-Managed Super Funds (hereafter simply referred to as SMSF’s).

If you are looking for a classic “How long is a piece of string?” question you could do far worse than selecting the question that we are attempting to address with this guide: “How much money do I need to retire?”

It should come as no surprise that if your mortgage is your single biggest expenditure, then cutting the cost of your mortgage is likely to be your single biggest money saver.

It is quite possible that the title of this eBook might strike people as slightly strange.

As a surgeon you have probably long realised that your financial profile and needs differ considerably from that of people of other professions.

If you are in a committed same-sex relationship you will no doubt, be following the debate on marriage equality with keen interest.

As a pilot you have probably long realised that your financial profile and needs differ considerably from that of people doing ‘normal’ jobs.

As a professional athlete, you have probably long realised that your financial profile and needs differ considerably from those of people doing ‘normal’ jobs.

Getting your finances under control doesn’t have to be difficult. The fact that you have downloaded this eBook probably means that you are interested in your finances and wanting to improve them.

Exchange traded funds (ETFs), listed investment companies (LICs) and unlisted funds are all managed investment vehicles with some similarities.

Exchange traded funds (ETFs) are a managed investment vehicle that you can use to access a wide variety of investment markets.

For many Australians, it is a reality that at some point the family home will be sold (voluntarily or not) to prepare for, fund or fuel retirement.

The aim of this eBook is to help you understand why medical professionals on the whole may be disadvantaged when it comes to creating wealth and suggest a range of strategies that could help to overcome these disadvantages.

My accountant once quipped that the greatest threat to wealth creation was not tax, but divorce. He wasn’t worrying too much; he earned large fees from assessing family property settlements as a result of relationship breakdowns.

The purpose of this eBook is to provide information on consolidating super. If you’ve changed jobs over the years, it’s likely that you’ll have more than one superannuation account.

‘Self-Managed Superannuation Funds’ (hereafter referred to as SMSFs) can be a tax effective and efficient way of saving for your retirement.

Are you controlling your finances or are they controlling you? It is a sad fact that far too many Australians are forced to admit to the latter option.

Owning your own home is considered to be every Australian’s dream. However, buying a home is a major investment for anybody and will probably be one of the largest investments you will make during your life.

Getting access to funds in your superannuation fund when approaching retirement used to be an ‘all or nothing’ affair.

Being retrenched from a job is not part of anyone’s ideal career path. It is, however, something that will happen to many people over the course of their working lives.

If you are a retiree in Australia, there is a range of government financial help available if you meet eligibility requirements.

More Australians are realising that directing their retirement funds towards a Self-Managed Super Fund (SMSF) can be an efficient and potentially beneficial way to maximise their retirement assets.

Investing is the best way to build your long-term wealth provided you make smart investment decisions and you take a long-term view.

Think of location and property, and comments such as ‘it’s a block from the beach’, ‘there’s a school within walking distance’, or ‘the train station is two blocks away’ probably come to mind.

Every day our financial advisers help clients create plans to follow a sure, steady path to building wealth. But what happens if you are the recipient of unexpected new wealth?

The timing of your sale is likely to be crucially important, both in terms of the market in which you are selling as well as the ramifications on you personally, emotionally and financially.

Insurance. QSuper is the superannuation fund for current and former Queensland Government employees. It is the largest (with around 530,000 members) and also one of the oldest super funds in the State of Queensland and has over $5 billion under investment.

Congratulations! To achieve financial freedom you need to take action and simply by downloading this eBook you have taken an important first step towards this very worthwhile goal.

The Australian government has seen the problem of an ageing. population coming for some time as the “baby boomers” (those born between the years 1945 and 1965) inch closer and closer to the day of retirement.

The purpose of any super fund, including an SMSF must be for one or more of the core purposes; or one or more of the core purposes and one or more of the ancillary purposes,

Most of your super savings are preserved, or not accessible until you reach your preservation age, or meet one of the other prescribed situations contained in the super legislation. These are commonly referred to as a condition of release.

The following table summarises the current rules for when a person is allowed to contribute or receive contributions to a super fund for the 2023/24 financial year.

There are a number of steps you will need to follow to establish a self-managed superannuation fund (SMSF).

Every year, thousands of Australians nearing or in retirement confront the same frustrating bureaucracy: a complex and often confusing patchwork of federal and state concession schemes designed to ease the cost of living—but difficult to find, claim, or renew.

Renovations can be a nightmare to plan. If you're thinking of giving your home a makeover, try to avoid these mistakes.

Is your perception about your finances at odds with reality?

A well-stocked emergency fund can be absolutely vital when life throws you a curveball.

What does it mean for you if that seven figure sum proves to be elusive?

Investing can be rewarding, but what happens when you finally want to cash those investments in?

The Australian Government’s Home Guarantee Scheme has undergone a significant transformation with major policy reforms introduced from 1 October 2025.

For many Australians, the vision of retirement conjures up images of relaxation, freedom, and well-earned peace of mind.

You don’t want to let retirement creep up on you without a realistic plan.

As a parent, there are plenty of opportunities to teach your kids good financial habits.

The aged care system is getting an overhaul, with fees for half of new residents expected to go up.

Are there alternative pathways to property ownership you aren't considering?

In life, there are big moments that mark new chapters. But these don’t often come cheap.

Our health needs change over time, and as we age it’s good to catch risk factors early.

Want to land your kids with a big tax bill? We didn’t think so.

Before you and your partner combine finances, make sure you’re clear on what you’re getting into.

What can you do now to start retirement on the right foot?

The reality of being single is it often comes with hidden extra costs.

Periods of sustained market decline, such as multi-year bear markets, are rare but influential events in the financial lives of investors.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” These words, often attributed to Einstein, echo across generations for a reason.

When life throws you a curveball—a broken-down car, an unexpected medical bill, or simply the temptation of a flash sale—how do you respond?

Imagine being faced with a simple choice: you can have $100 today or $120 if you’re willing to wait a year. The rational response may seem obvious—wait for the higher payout.

Philanthropy in Australia is changing. It’s no longer just for the wealthy or for big corporations - everyday Australians are discovering how giving can be both deeply rewarding and financially smart.

Tempting as some job offers might be, they’re very often traps.

Having a clear plan can help make retirement the relaxing and rewarding time it’s meant to be.

There are less-trodden paths to home ownership that can be just as rewarding.

Here are a few helpful money moves to make before your bundle of joy arrives.

As useful as debt can be, there are some kinds that can be more trouble than they’re worth.

Change is daunting, but there’s no better way to calm your nerves than to dip your toes into the water.

Many newly retired Australians find themselves worrying about withdrawal rates and how long their savings will last. But this strategy can help.

A seven figure net worth might seem unattainable, but there’s some pretty simple maths at its core.

Those who start investing early might have an advantage, but there’s still plenty to gain for latecomers.

Giving an inheritance is one of the most generous things you can do for your children, but the timing can make all the difference.

In this video from The Guardian, Treasurer Jim Chalmers delivers a speech on the floor of Parliament during Budget night.

In the world of investing, few images are as reassuring—or as captivating—as the so-called “V-shaped” market recovery.

When it comes to preparing for retirement, many Australians focus on growing their superannuation individually.

Dividing assets after divorce can be tricky, but what about debts?

Share prices go up and down, but prolonged downturns can be the ultimate test of resilience.

Running your own super isn’t as simple as setting up a few investments and watching them grow.

Jumping from one career to another can be rewarding, but you’re going to need a plan.

What does psychology tell us about staying happy and healthy, maintaining a sense of purpose, and making the most of your retirement years?

Wealth, Wisdom, and Wellbeing: How End-of-Year Super Planning Can Secure Your Future

Australia stands at a pivotal demographic juncture. As the government incrementally raised the Age Pension eligibility age from 65 to 67-a transition completed in July 2023- there is growing debate about the broader social consequences of such reforms.

If money issues are weighing on your mind, here are five strategies to help ease financial stress.

You'll be glad you considered these crucial factors when it's time to claim.

There's a fine line between being cautious and compromising the retirement you deserve.

Many tax deductions are obvious and well known, but there are several that fly under people’s radar. Are you missing out?

The decisions you make early on can have an outsized impact on your returns over time.

Introduction: The Rise of Family Trusts and the Challenge of Relationship Breakdowns

Market volatility is an inevitable part of investing, yet it often evokes fear and uncertainty among investors. The phrase “catching a falling knife” vividly captures the dangers of trying to time the market during sharp declines—it suggests that attempting to buy assets during a precipitous drop can lead to painful losses.

Australia finds itself at a critical juncture. The nation’s economy, while resilient in many respects, faces mounting pressures from stagnant real income growth, rising costs of living, and declining productivity.

In this video from The Guardian, Treasurer Jim Chalmers delivers a speech on the floor of Parliament during Budget night.

Treasurer Jim Chalmers handed down the 2025-26 Federal Budget on Tuesday, and there’s a lot to unpack.

Money can be a source of joy or tension in a relationship. Here are a few things you and your partner can do to win together.

Whether you’re saving up for a home or you just want some extra breathing room in your budget, small changes can make a big difference.

Estate planning can be a minefield of potential missteps, especially if you don’t have the right experts on your side.

Planning for retirement can be difficult when you don’t know how long you’ll live.

When you’re new to investing, you’d be forgiven for focusing solely on returns. But no investment strategy is complete unless it factors in tax.

In the unpredictable world of investing, where the promise of high returns often dazzles, a quieter principle shines through the "silver rule" of investing.

After a brief downswing, national average property prices hooked back up in February, reflecting the anticipation and then reality of the RBA starting to cut rates.

In the realm of investment strategies, dividend investing has long held a special place in the hearts of Australian investors.

Financial educator Vanessa Stoykov offers some tips to help shift your attitude towards money.

The ABC breaks down some of the main announcements from the 2024-25 Federal Budget.

In this video from the ABC, Treasurer Jim Chalmers delivers a speech on the floor of Parliament during Budget night.

It can be challenging to talk about money across generations. But starting those conversations with your parents can be crucial, especially when there are inheritances involved.

Many people aren’t comfortable discussing money, even with their partner. But sweeping money matters under the rug can lead to problems down the track.

Important as they might be, good financial management skills aren’t always taught in schools. What are some strategies parents can use to get their kids thinking about money?

Seeing your super or investments take a hit during a period of market volatility can be hard to stomach. But it pays to remember that fluctuations in share prices are part and parcel of investing.

It’s easy to ignore your super, but doing so can come at a great cost. Behavioural finance expert Simon Russell offers some tips to help boost your retirement savings if they’re off track.

Financial educator Nicole Pedersen-McKinnon offers a few tips for families looking to maximise their super.

Not sure what to do with the spare cash you have lying around? Financial educator Nicole Pedersen-McKinnon offers some tips.

Behavioural finance expert Simon Russell shares some ways that gaps in our knowledge can affect our plans for retirement.

Nicole Pedersen-McKinnon shares some tips to save money while still getting the most from your health insurance.

It can be difficult seeing your super balance go up and down, especially if you’re approaching retirement age. Here are some strategies to help you stay calm.

If you’re worried about making your retirement savings last, it might be time to switch things up a bit. The three bucket strategy is one approach worth considering.

Nicole Pedersen-McKinnon shares some of the options available to mortgage holders who might be struggling to service their loan.

No one wants mortgage debt hanging over them for longer than necessary. Nicole Pedersen-McKinnon offers some strategies to help you become debt-free sooner.

Watch the ABC News interview with Treasurer Jim Chalmers, where he discusses the measures outlined in the 2023-24 Budget.

This ABC News video explores some of the winners and losers of the 2023-24 Federal Budget.

Financial therapist Jane Monica-Jones shares some useful strategies to have in your toolkit if things get tough.

Inflation; it’s one of the most talked about topics right now. But what can it mean for your longer term financial position?

Simon Russell of Behavioural Finance Australia shares some insights to help get your super savings on track this year.

In this entertaining TED Talk, Riley Moynes offers some words of wisdom on how to make the most of your golden years.

Watch the ABC News segment on Labor’s 2022-23 Federal Budget and some of the proposed measures that underpin Labor’s promise of ‘Building a better future’.

In this ABC News video, Treasurer Jim Chalmers talks to Sarah Ferguson about the hard decisions that had to be made in Labor’s first Budget in nearly a decade.

If you’re nearing retirement, it’s important to make sure you understand sequencing risk and how to manage it.

Dr Joanne Earl from Macquarie University shares her research insights on the key ingredients to a positive and happy retirement.

Your home loan will likely be the largest debt you pay off in your lifetime, by taking a proactive approach you could free up cash flow sooner.

Dr. Kirsten MacDonald from Griffith University provides critical insights on how to avoid a triple whammy when making investment decisions in a crisis.

The 2022-23 Federal Budget papers provided information on the Government’s policy priorities (and proposed policy measures). In this ABC News video, James Glenday delves further into this information.

Treasurer Josh Frydenberg announced many proposed policy measures in the 2022-23 Federal Budget. In this ABC News video, Leigh Sales interviews the Treasurer to discuss these measures in more detail.

On 1 February 2022, the RBA made the decision to maintain the cash rate target at 10 basis points. In this ABC News video, Alan Kohler discusses his thoughts on home loans and interest rates.

If you are considering the sale of business assets, you may be eligible for CGT concessions, which could help with any associated capital gain. In this animation, we illustrate small business CGT concessions.

The increase in remote working is likely here to stay—one way (fully remote) or another (hybrid). In this video, there are tips on how to work remotely without having productivity or wellbeing suffer.

Making an insurance claim after an unfortunate health event can add additional stress, especially if you are unfamiliar with the claims process. In this animation, we illustrate the claims process.

Saving for a home deposit can be a significant hurdle for first homebuyers. In this animation, we illustrate several thoughts and tips for prospective first homebuyers looking to save a home deposit.

What keeps us happy and healthy as we go through life? In this TED Talk, Robert Waldinger shares lessons learnt from a study on happiness, and practical wisdom on building a fulfilling, long life.

In pre- and post-retirement, it’s important to understand the risks retirees can face and have a retirement plan in place to help weather them. In this animation, we illustrate longevity risk.

It can be difficult for someone who is separated or divorced—especially with children—to save an adequate home deposit. In this animation, we illustrate the finer details of the Family Home Guarantee.

Retirees will often experience three chapters as they progress through their retirement years: the early, middle, and late chapters. In this animation, we illustrate these three retirement chapters.

In the ever-changing landscape of financial markets, few voices carry as much weight as Warren Buffett’s.

If you play your cards right during a period of low rates, you can reap financial wins that pay off in the long term.

Commencing retirement doesn’t necessarily mean your tax paying days are behind you.

If your relationship ends, having a plan in place for your assets could spare you a lot of stress and heartache.

Going guarantor on your child’s mortgage can help fast track their home ownership goals. But as a parent, there’s a lot you’ll need to know before jumping on board.

Whether at the petrol pump or the supermarket checkout, sharp price increases are never welcome. But are there things we can do to protect against inflation?

“The Richest Man in Babylon” by George S. Clason is a classic personal finance book that was first published in 1926. It is a collection of parables set in ancient Babylon, which teach simple yet powerful financial lessons that are still relevant today.

Clearly residential real estate has defied the many doomsday forecasts made over the last few years, having moved through the bottom of its cyclical downturn in early 2023 and experiencing an overall strong recovery since.

When it comes to money, many of us are walking around with a set of rules that limit our ability to thrive financially.

Estate planning is a delicate business, and despite your best efforts there’s always a chance things might take a turn for the messy after you’re gone.

Regardless of your age, income or life goals, there are a few things everyone should consider putting on their financial to-do list this year.

It’s common for parents to give cash, cars, and even shares and property to their children. But how tax is applied — and who it’s applied to — differs across the board.

All those market fluctuations you learned to live with throughout your working life become much more consequential as you approach retirement.

In the lead-up to divorce, it’s crucial for women to grasp key financial principles before taking this life-changing step.

The more you know about the threats to your retirement savings, the more in control you’ll feel whenever they arise.

For many people, the life insurance discussion only starts in earnest when children enter the picture. But how exactly can the right life insurance benefit your family?

While there’s an excitement to not knowing what your post-work years have in store for you, chances are you don’t want to put a foot wrong.

Losing a loved one can be a devastating time, and it’s made all the more difficult if it falls to you to handle all the death-related admin.

Australia’s cities have long been viewed as engines of economic growth and opportunity, drawing people from across the nation and around the world with the promise of higher wages and enhanced career prospects.

Australia’s housing market has long been a cornerstone of wealth generation, yet its increasing inaccessibility poses significant challenges to financial stability and retirement planning.

Many Australians enter retirement with a lot of their wealth tied up in their home. But extracting cash from your property doesn’t have to involve selling it.

Though we might understand that there are more important things in life than money, it can be hard to keep things in perspective when others seem to be spending with abandon.

Most people will experience a financial setback at some point in their lives. But there are some events that can turn your world on its head and force you to start over.

Your insurance shouldn’t be set-and-forget. In fact, there are plenty of situations where reviewing your insurance can leave you and your family better off.

We tend to associate the term ‘cash flow’ with operating a business, but familiarising yourself with the concept can strengthen your personal finances too.

Beneficiary nominations are a vital aspect of superannuation that often go overlooked.

In today’s volatile financial landscape, navigating market fluctuations and securing wealth for future generations requires more than just strategic investments.

“Common Stocks and Uncommon Profits” is a seminal work on investing by Philip A. Fisher, first published in 1958. This influential book outlines Fisher’s investment philosophy, which focuses on identifying and investing in high-quality growth companies for the long term.

Investors often fall into the trap of thinking they’re more skilled than they actually are. But even if you’ve experienced a handful of wins, things can quickly take a turn.

Financial literacy in school age children is important, but the stakes get much higher once your kids start working and earning an income.

Financial freedom is about being able to pursue the lifestyle you want without being weighed down by financial concerns. We explore how you might be able to achieve that.

There are plenty of different investment types to choose from, but one of the more important distinctions you’ll encounter is between passive and active investments.

As you or your parents grow older, it’s easy to find yourself worrying about the cost of aged care. But is it so expensive that you’ll be forced to sell your home?

“The Psychology of Money” by Morgan Housel is a captivating exploration of how our minds shape our financial decisions. This insightful book delves into the com- plex relationship between human behaviour and money management, offering a fresh perspective on personal finance that goes beyond traditional advice.

Estate planning is a crucial aspect of financial management that extends far beyond simply writing a will. It encompasses a range of strategies and legal arrangements designed to manage and distribute your assets after your death, as well as to plan for potential incapacity during your lifetime.

Simon Russell explores some of the mental shortcuts people often rely on when conducting their financial affairs, and whether we should use them more or discard them altogether.

Transferring a property to your child isn’t just a matter of swapping out the name on the title. There might be significant costs that both parties should prepare for.

Despite all your planning and budgeting, there’s every chance that you’ll encounter surprise expenses in retirement. We examine just a few.

Your annual super statement is a snapshot of how your super is going, but it’s also an opportunity to take a look under the hood and make sure you’re happy with its current settings.

Your super is likely one of your biggest financial assets, and unfortunately that makes it a popular target for scammers. We look at a few tactics they might use and what you can do to help stay safe.

While your super can seem like a 'set and forget' investment, you might find there are more suitable options than the default ones.

There are plenty of ways to give your child a head start financially. But is contributing to their super a good idea?

It’s no easy topic to broach with your parents, but if you’ve been putting off the aged care conversation, here are a few questions that can help get the ball rolling.

If you’re worried about entering retirement with lingering debt, here are a few things to keep in mind.

Having a blended family can add a whole lot of complexity to the estate planning process. Here are a few strategies to help give you peace of mind.

The world has undergone a transition in its financial climate, moving from low-rate, stable inflation conditions to a period of higher rates, a spiralling cost of living and rising uncertainty across financial markets.

The Encyclopaedia Britannica website explains that life expectancy is “an estimate of the average number of additional years that a person of a given age can expect to live.” The key word here is average, and there are different ways of calculating it.

The superannuation guarantee (SG) payment for PAYG employees increased by half a percentage point to 11.5% on July 1, 2024. This means employers are now required to con- tribute a higher percentage of an employee’s salary to their superannuation fund, boosting retirement savings for workers across Australia.

Changes in the value of the Australian dollar are important as they impact Australia’s international export competitiveness and the cost of imports, including that of going on an overseas holiday.

Is it better to pass on your wealth with warm or cold hands? As always, the answer depends. But there are a few pitfalls you should be aware of with each.

If you’re thinking about retiring soon, take some time to review your financial position and think about which of the following categories you might find yourself in.

The Stage 3 tax cuts have finally come into effect. We explore a few alternatives to spending the money that might benefit you in the long run.

Your child is sure to learn plenty of important money lessons once they start earning an income, but there’s still plenty you can do to nudge them in the right direction.

Behavioural economist Simon Russell discusses some of the ways that our unconscious mind might be calling the shots when it comes to investing.

As medical advancements and improved living conditions continue to extend human lifespans, the traditional concept of retirement is undergoing a significant transformation.

Today’s story looks at two key factors that determine the answers to the big questions when planning retirement finances: ‘How much do I need?’, and ‘How much can I afford to spend?’ - in order to have confidence that you can maintain your living standards, not run out of money, and not have to rely on welfare.

Superannuation, divorce and family law can be difficult enough to navigate on their own, but things can get especially complex when they’re bundled together. Here are some things to keep in mind when splitting super with an ex-spouse.

As the 2023-24 financial year draws to a close, we bring you a wrap up of important 1 July changes and some strategies to help put you in a strong position for the coming year.

If elaborate spreadsheets aren’t your thing, you might use these metrics to get a sense of how your finances are faring — and how far you have to go to reach your goals.

Knowing you’ll inherit your parents’ home may be welcome news, but things can get very tricky if you have siblings you’ll have to share it with. Here are a few avenues you might find yourself considering.

The demographics of how long we will live reveal some surprising statistics, especially in Australia. We frequently hear about people living into their nineties, and even one hundred years or more, but we read less about the other side of the demographics: how short many lives will be.

In the six months of my ongoing battle with brain cancer, one part of financial markets has fascinated me whenever I find time to read.

The Labor Government’s 2024-25 Federal Budget was unveiled on 14 May. We look at how the Government plans to manage the cost of living crisis while also keeping inflation in check.

If a relative or loved one dies owing money, does it fall on their next of kin to cover any unpaid debts? The answer might be more complicated than you first thought.

Take it seriously and your super will likely end up among the most important financial assets you own. Here are a few goals to keep in mind if you're looking to boost your super, no matter your age.

A redundancy payment can help lessen the sting of losing your job. These payments can sometimes be quite generous, so questions around tax are bound to come up.

You won’t be blamed for avoiding thinking about death and total and permanent disability (TPD) insurance. But depending on your occupation you might be doing yourself a disservice.

The Australian housing market is a complex and multifaceted landscape that can be challenging to navigate for beginners.

In Australia, baby boomers, born between 1946 and 1964, are shaping the housing landscape with their unique preferences.

If you’ve given your child an early inheritance or a large sum to help buy a property, you might be wondering what would become of it if they were to split up with their partner.

Circumstances change, and you might be thinking about returning to work after having entered retirement. But is this allowed if you’ve already accessed your super?

Receiving a large sum of money can seem like a blessing at first. But the novelty and excitement can quickly give way to stress and decision paralysis.

Australians lost a total of $477 million to scams last year, with the majority of victims falling in the over-65 category. Here are a few common ploys used by cybercriminals you should be aware of.

If you’re looking to maximise your superannuation, it’s a good idea to be up to speed on any legal updates that could affect the super and tax landscape.

After another 80% or so plunge from its high in 2021 to its low in 2022, Bitcoin has rebounded again to a new record high.

Cheques and bank service, or the lack of, were major topics when I addressed a seniors’ group recently. The word had got out that the government was phasing out cheques, and many of the members of the audience were feeling abandoned.

It’s an age-old question, is it possible for a person to time the share market? All the data seems to be pointing very firmly to no. It’s simply too hard to do.

Late last year, Phoenix participated in an Investor Day, hosted by listed REIT, Mirvac Group, that focused on ‘Living Sectors’.

Having enjoyed a better than feared consumer-led recovery from COVID lockdowns, Australia’s economy in recent years has quickly been beset by a new problem

The Australian welfare system, including the Age Pension, was designed on the assumption that older people own their home and can age there.

I recently happened upon a practical and often humorous book about how to age successfully.

Over age 60, superannuation benefits paid as either a lump sum or pension are tax free and not assessable for income tax.

The world’s best investor, Warren Buffett, has suffered from the same disease that plagues every other successful fund manager in the world - fading out-performance over time.

Older Australians might be feeling their creaky knees, stiff backs and failing eyesight, but one thing they should not feel is neglected by government departments and agen-cies studying their potential financial futures.

There are valid reasons why economics is called the dismal science, and even the origin of the expression is distasteful.

Our post-work years often lack the structure and meaning that our working years did. For those looking for a substitute, volunteering might be the answer.

There’s been a lot of focus on the rejigged stage 3 tax cuts. But there’s another way to potentially reduce your taxes, and it receives comparatively little attention.

Today’s property landscape might seem unfriendly to first home buyers, but do younger Australians really have it worse than their parents did?

It’s not the end of the world if you and your partner aren’t totally compatible when it comes to money. But things can get particularly messy when one partner feels the need to lie to the other.

It’s common for retirement to not live up to our expectations. If you’re feeling nervous about your post-work years, here are a few things to keep in mind.

For some people, the financial impact of divorce can be as devastating as the emotional impact. Here are some tips to help you make it out the other side with your finances intact.

Many business owners understand the importance of keeping overhead low, profits high, and doing what they can to stay ahead of the curve. As individuals, we might be able to apply some of these strategies in our own lives.

If all has gone according to plan, you’ll have enough super to live comfortably in retirement. But there’s more than one way that super can be paid out, and what you choose to do with yours can make a big difference.

Cost of living pressures have piled on over the last 12 months, and many Australians have entered the new year with a sense of apprehension. For anyone looking to ease the stress, these tips might be a good starting point.

If the prospect of a comfortable retirement wasn’t incentive enough, there are a number of ways Australians can boost their retirement savings and save on tax at the same time.

How to accumulate money, spend it, and put it to work in service of our long-term goals are all important questions, and they tend to evolve as we age. Here are some common financial goals for each decade of life.

The challenges faced by both renters and first home buyers in 2023 look set to continue this year. Are you better off picking one over the other?

Retirement isn’t always as glamorous as it’s made out to be, but things can be especially challenging if the decision to leave the workforce wasn’t yours to begin with.

Whether you’re scouring the job boards or sitting across an interviewer, a prolonged absence from work can hurt your confidence. If you’re looking to get your career back up and running, here are some tips that might help.

Markets have seen an influx of new investors over the last few years, but many Australians remain painfully unaware of some of the tax rules that apply.

There’s a lot more to the estate planning process than getting your Will sorted. Here are a few additional items that, depending on your situation, you might need to check off the list.

No one knows with certainty what their post-work years will look like, but there’s a lot we can do to help secure the retirement we want.

For financial educator Vanessa Stoykov, changing our attitude towards money means first understanding all the things that shaped it in the first place.

During your retirement years, you can access a portion of your super to fund your day-to-day needs while the bulk of your balance remains invested.

An early inheritance can make all the difference in your child’s life, but there are plenty of issues you’ll need to be aware of before parting with your cash.

The Age Pension is an important source of income for millions of Australian retirees. But there are plenty of rules you’ll need to be aware of before you apply.

Being proactive when it comes to your super can potentially have major benefits. Here are some steps you can take to help bring the retirement you want within reach.

Writing a Will can be a daunting — not to mention emotional — task. But without considering these questions, your efforts at end-of-life planning may be incomplete.

The low fixed rates many Australians locked in over the pandemic period are gradually expiring. If you’re worried about what’s on the other side of the fixed rate cliff, here are some tips to help you with coping.

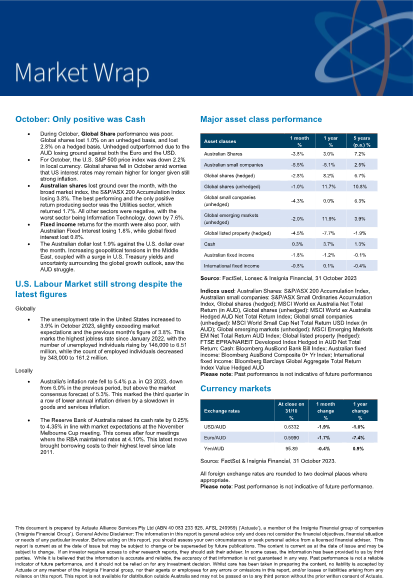

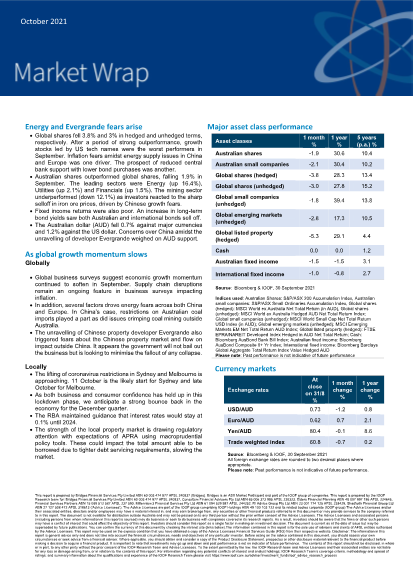

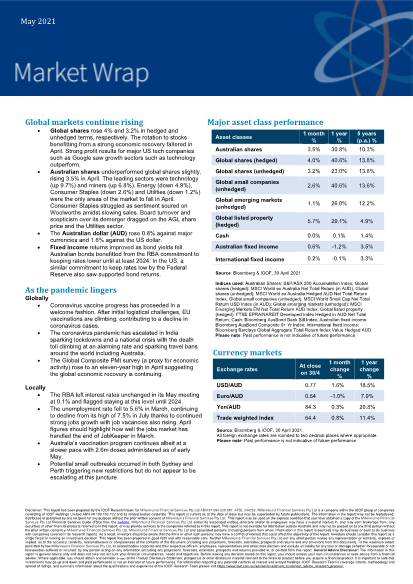

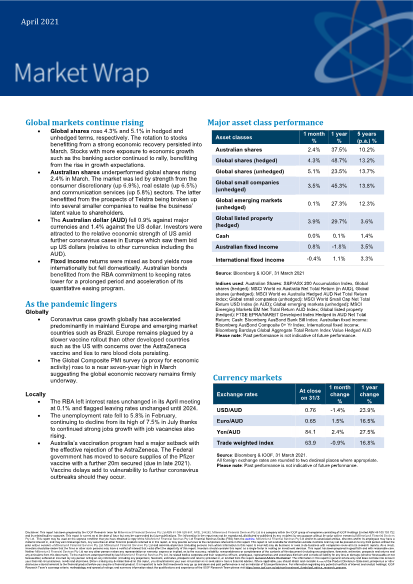

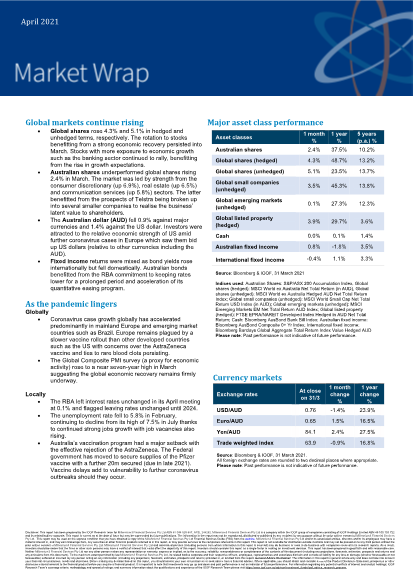

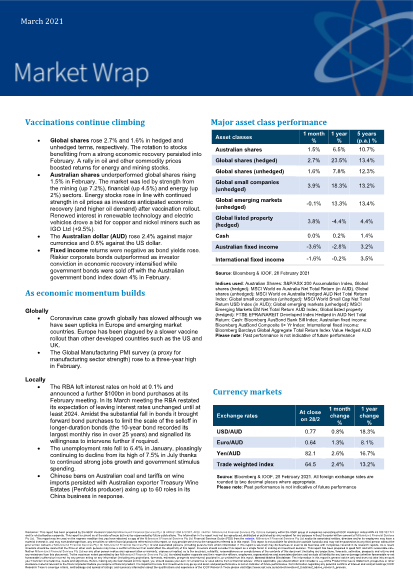

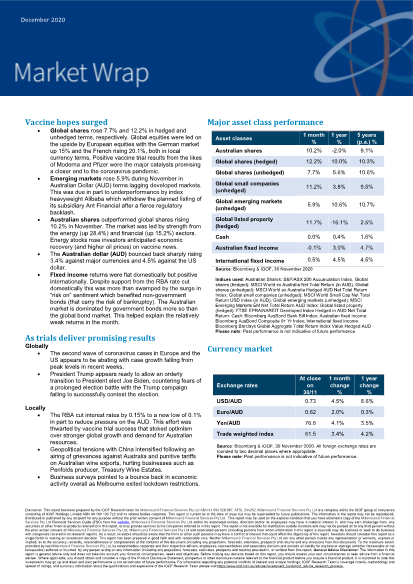

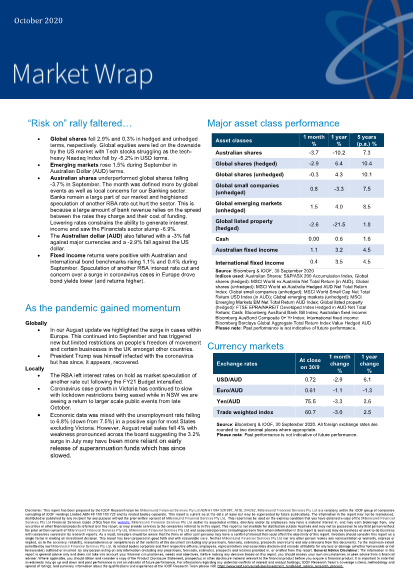

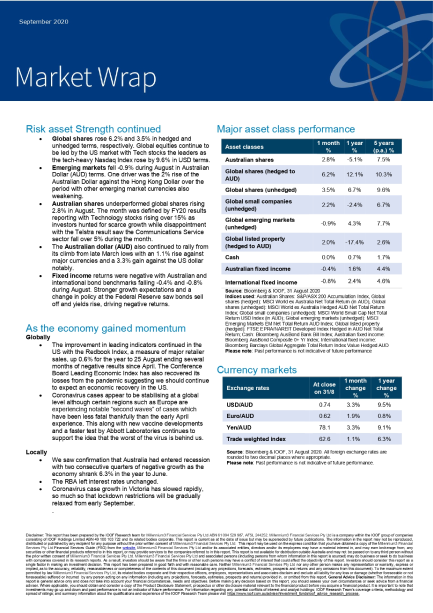

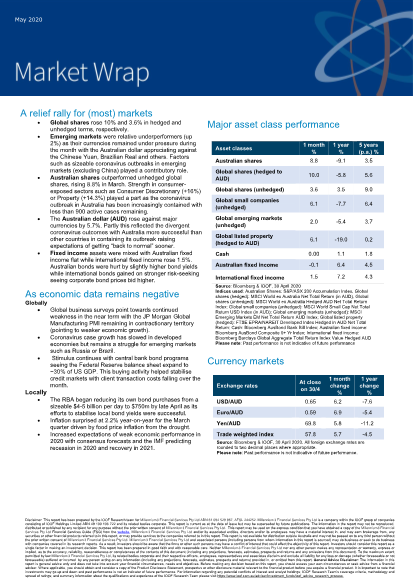

During October, Global Share performance was poor. Global shares lost 1.0% on an unhedged basis, and lost 2.8% on a hedged basis.

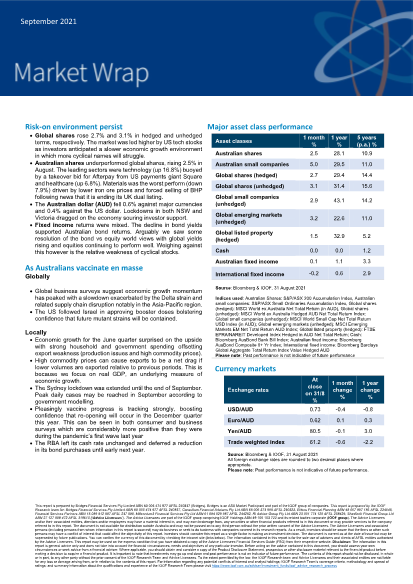

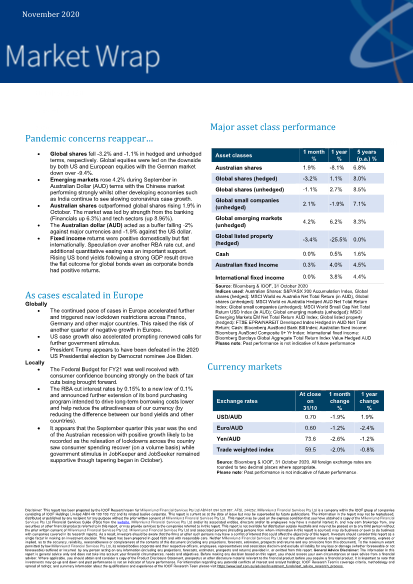

During September, Global Share performance was poor. Global shares lost 4.0% on an unhedged basis, ..

During August, Global Share performance was mixed. Global shares gained 1.6% on an unhedged basis, but lost 2.2% on a hedged basis, due to a depreciating AUD relative to the USD.

Learn to spot the telltale signs of fraudulent messages and help keep your finances safe.

Is your empty nest no longer empty? Here are some ways to navigate the emotional and financial challenges of an adult child moving back home.

If you’re looking to invest for your child, you should know there can be major drawbacks to doing so in their name.

Are you confident your super will go to your preferred beneficiary if you pass away? Here are a few scenarios that might cause trouble for you.

There’s more to your super statement than how well your fund has performed. Here are a few questions to ask when you receive yours.

For anyone with uni debt, the recent indexation increase of 7.1% might come as a shock. Here are a few things to keep in mind.

Super funds invest in many different assets to grow members’ retirement savings, including unlisted assets. But do you know how they work?

AI is on the rise, and one group that’s been quick on the uptake has been cybercriminals. Here are just some of the ways the tech is being used to scam and steal.

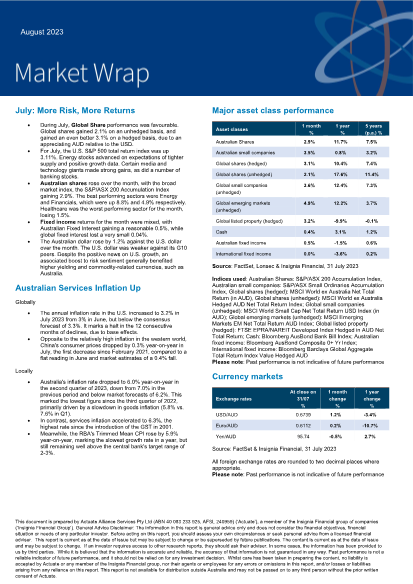

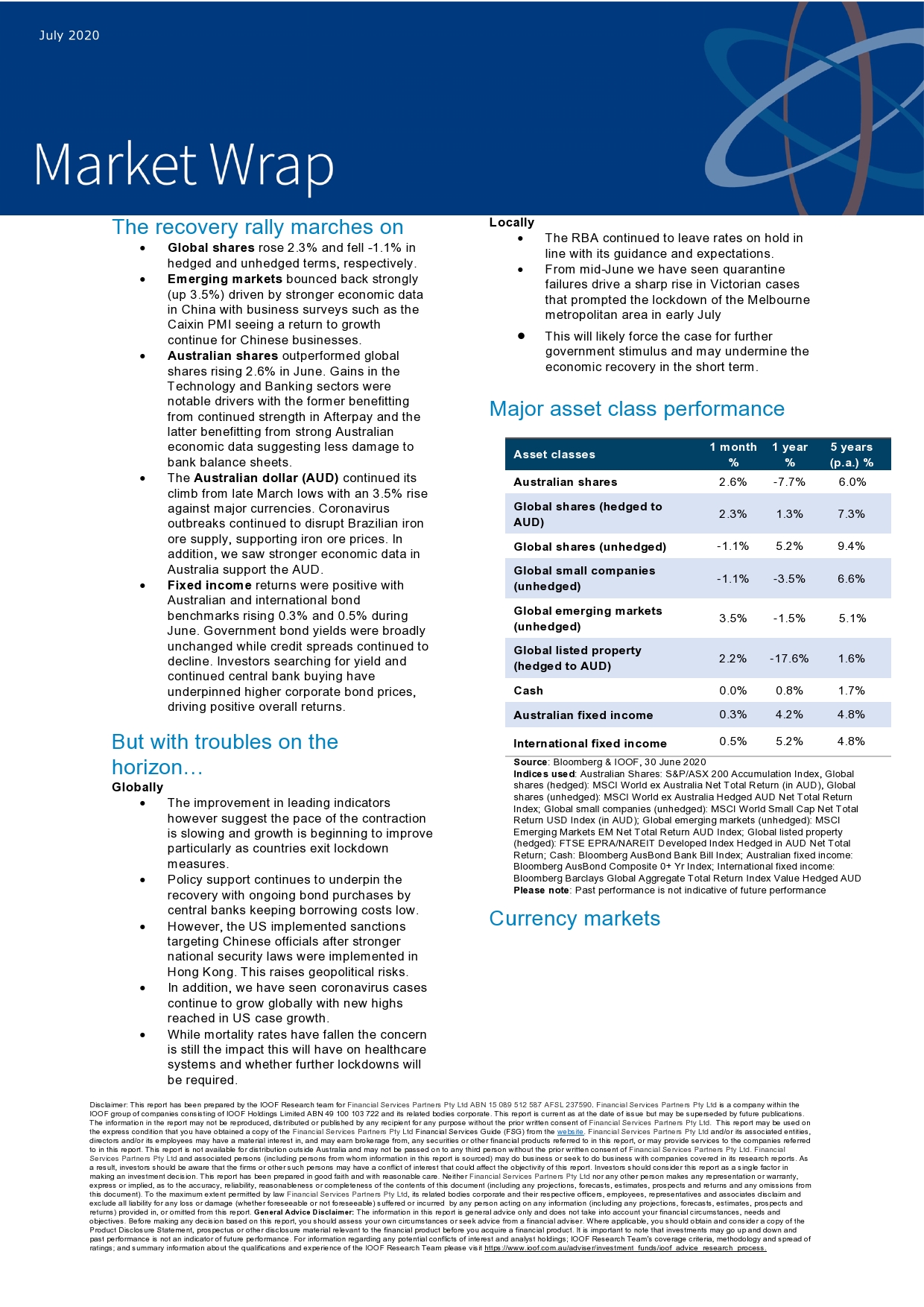

During July, Global Share performance was favourable. Global shares gained 2.1% on an unhedged basis, and gained an even better 3.1% on a hedged basis, due to an appreciating AUD relative to the USD.

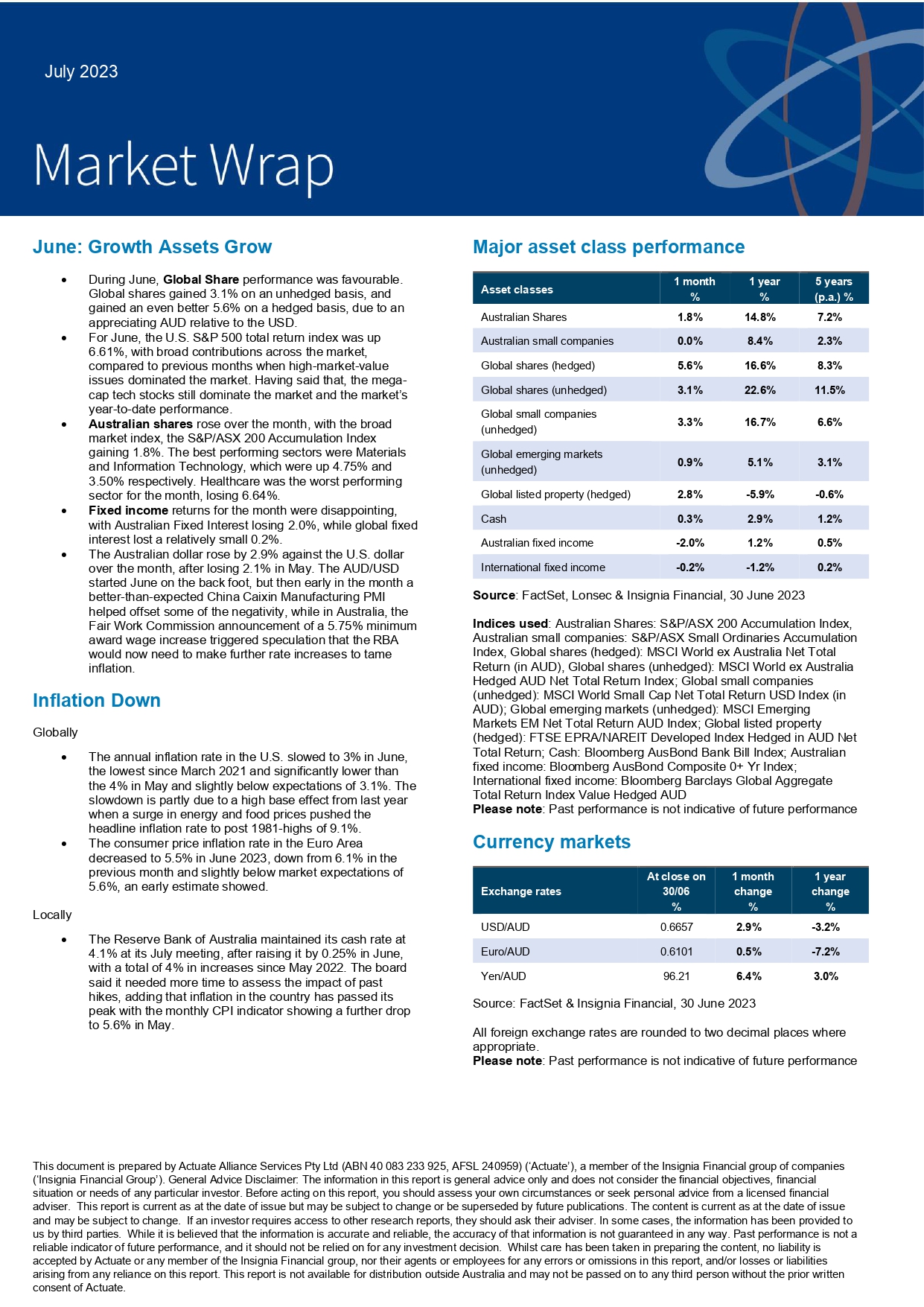

During June, Global Share performance was favourable. Global shares gained 3.1% on an unhedged basis, and gained an even better 5.6% on a hedged basis, due to an appreciating AUD relative to the USD.

Beating inflation is no easy task, but Nicole Pedersen-McKinnon offers some handy tips to help make the rising cost of living more manageable.

The most valuable thing you own might not be your home, your car, or even your investment portfolio. We look at how to protect this often overlooked asset.

A lot has changed in the tax and super space this new financial year. Here’s a rundown of some of the most important items you should know about.

When it comes to your super, small decisions can have significant consequences. If you’re worried about things snowballing, consider these strategies.

High inflation may have complicated your plans to retire early, but there are few things you should consider before giving up.

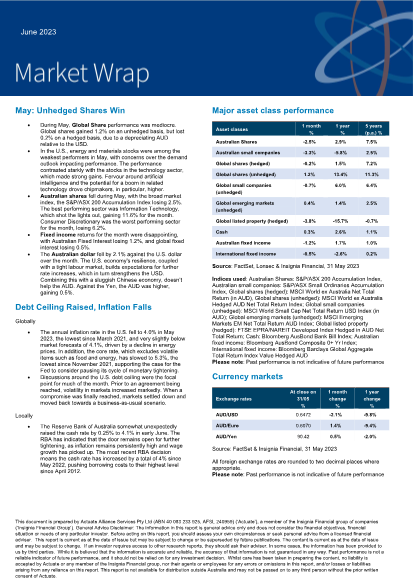

During May, Global Share performance was mediocre. Global shares gained 1.2% on an unhedged basis, but lost 0.2% on a hedged basis, due to a depreciating AUD relative to the USD.

Worried that you won’t be able to give your family a helping hand in life without dipping into your retirement savings? Here are a few tips.

Do you struggle with impulsive spending or find saving money a chore? These small behavioural changes could help.

Rising interest rates have been a thorn in the side of mortgage holders. But there is some good news to come from the RBA’s rate hikes.

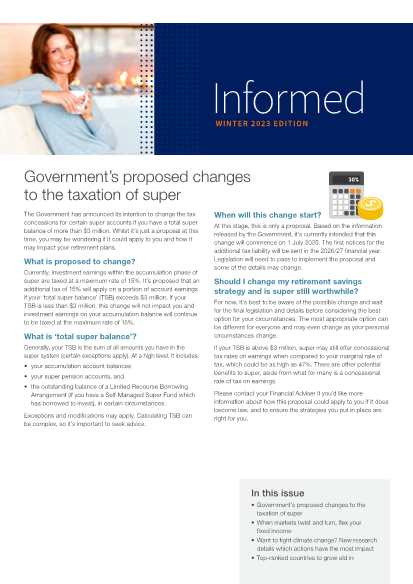

The Government has announced its intention to change the tax concessions for certain super accounts if you have a total super balance of more than $3 million.

If you’re an employee receiving the standard super guarantee (SG) rate, you can look forward to a super boost from 1 July 2023 when the SG rate increases from 10.5% to 11%.

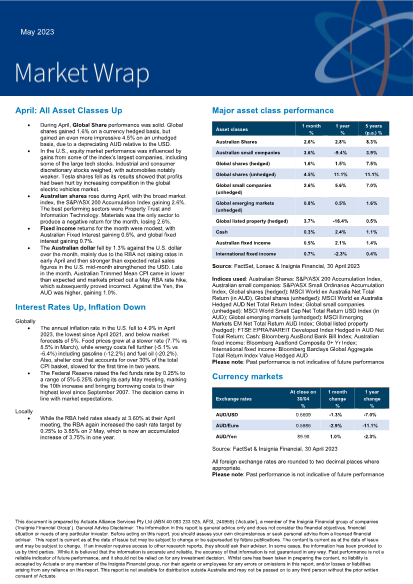

During April, Global Share performance was solid. Global shares gained 1.6% on a currency hedged basis, but gained an even more impressive 4.5% on an unhedged basis, due to a depreciating AUD relative to the USD.

If rising rental payments have fuelled your desire to break into the property market, here are a few government programs that may help.

As far as life changes go, a breakup can be among the most stressful. Here are some tips on how to make it out the other side with your finances intact.

We look at some of the reasons your pension payments might be falling short and what you can do about it.

Tax time is often stressful, but with a few smart strategies you may be able to minimise your tax burden and give yourself a nice little refund at the same time.

On Tuesday 9 May, Treasurer Jim Chalmers handed down the 2023-24 Federal Budget. Read about what the proposed measures could mean for you.

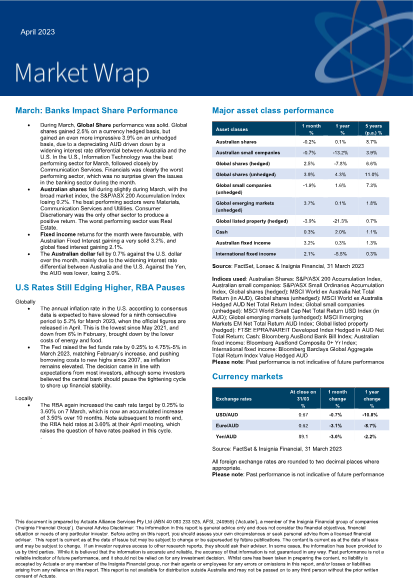

During March, Global Share performance was solid. Global shares gained 2.5% on a currency hedged basis, but gained an even more impressive 3.9% on an unhedged basis, due to a depreciating AUD driven down by a widening interest rate differential between Australia and the U.S. In the U.S., Information Technology was the best performing sector for March, followed closely by Communication Services. Financials was clearly the worst performing sector, which was no surprise given the issues in the banking sector during the month.

You don’t need a lump sum to keep the momentum going on your investments. Smaller, regular investments can be just as powerful.

If you’re suffering from Fear of Running Out (FORO), we’ve got some ideas to get you unstuck and on track with your future.

When mortgage repayments are on the up, using your home loan features to their full advantage can be a smart strategy.

We share some smart strategies to help keep your plans to start a family firmly intact.

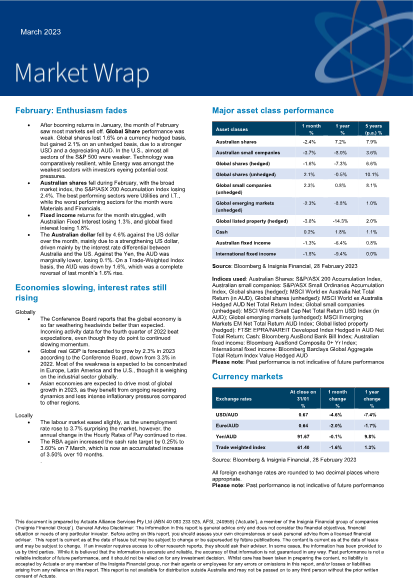

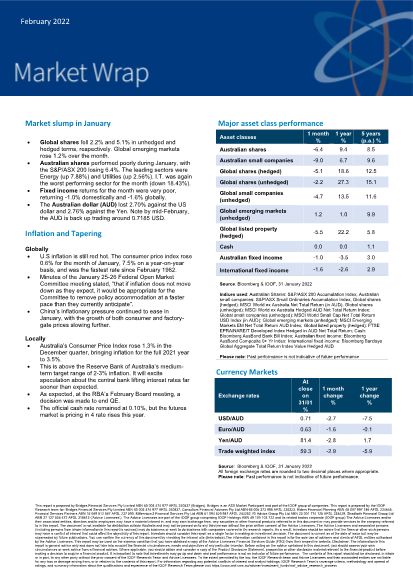

After booming returns in January, the month of February saw most markets sell off. Global Share performance was weak.

Insurance premiums that are deducted from your super balance are easy to forget about. If you have insurance through super, read on.

Kick fear to the curb with some useful and practical tips on staying financially and emotionally resilient when things feel unsteady.

When was the last time you reviewed your Will? Do you even have one? Learn the common life events that can date your current Will.

Helping out loved ones is often part and parcel of being in a family. But are you overextending on your finances and time?

If you’re in your 50s and selling your home is on the radar, you may be able to use some of the proceeds to boost your super.

Contemplating a career change? Read on for some practical things to consider before you take the plunge.

Moving into aged care can be a daunting prospect. Louise Biti from Aged Care Steps shares some practical tips to help parents settle in sooner.

Conversations about money can be hard at the best of times. We share some tips on how to ease tension and get things flowing.

Learn some simple ways to help set yourself up to be fighting fit for the year ahead.

Behavioural finance expert Simon Russell shares some insights on the kind of goals that can lead to greater happiness.

Are you making the most of the types of super contributions on offer? We share three things that might just surprise you.

Investing in an education bond is one way to invest and save for a child’s education. We explain how they work.

Is a move to the country or coast in your near future? Make sure the practicalities stack up for you.

With the cost of fuel eating into household budgets, is it time to assess the financial merits of going electric?

If your leftover super is headed to adult children when you pass away, then be sure to take note of the significant tax implications.

With the holiday season upon us, now might be a good time to make learning about money fun. We share some ideas.

Taking some time out to reflect on the past twelve months can help set you up for a good year ahead.

Passing on your wealth to the next generation can come with complexities. Lawyer Katerina Peiros shares some common pitfalls to watch out for.

When is the ‘right time’ to sell a property? Read up on things to consider when weighing up your options.

Fraser Jack at Cyber Collective shares some essential ingredients to a safety-first mindset online, and practical tips to help protect yourself.

If you’re in the lead up to retirement, you may be wondering what you can do to help keep your retirement plans on track. Read on for some ideas.

If you have a habit of getting caught up in a last minute gift-buying frenzy, we’ve got some tips to help keep your finances under control.

On 25 October 2022, Treasurer Jim Chalmers handed down an updated 2022-23 Federal Budget. Read about what these proposed measures could mean for you.

Mortgage Broker Catherine Denney from Nook Money shares tips to help with getting a good outcome from a phone call to your lender.

When interest rates change, checking in on your savings strategy can be a good idea. We share some things to consider if you are thinking about investing in a term deposit.

Money worries can affect even the strongest relationships. We share some ideas on helping to keep financial harmony intact with your nearest and dearest.

Deciding on the type of aged care is often one of the most difficult decisions to make. We look at the main differences between in-home care, residential care, and retirement living.

Being self-employed can come with its challenges. If you have ‘lumpy’ income to deal with, here are a few tips on how to manage this income in good times, and bad.

Often the biggest realisations in life only come with lived experience. We share 5 life lessons that seem to have stood the test of time.

Is the thought of budgeting enough to make your eyes glaze over? Here are a few ideas to turn budgeting boredom on its head.

Simon O’Connor, CEO of the Responsible Investment Association Australasia (RIAA) shares some insights from their annual benchmarking report.

Is retirement something you dream about, or dread? We look at some things to weigh up when planning your retirement timeline.

Putting legal arrangements in place with family members might seem unnecessary, but it may help protect you and your children if things go wrong.

How is your financial health? Check in on your finances with these simple and practical tips.

Your annual statement can provide an opportunity to scrutinise your super. Here we cover some areas to review when it comes your way.

Hear from family lawyer Bhavesh Mistry about ways to get your financial affairs in order while you have time on your side.

Clearing debts can be a liberating experience. We look at good vs bad debt, and some common debt repayment strategies.

Introducing kids to the idea of investing to build long-term wealth could be life changing. We share some ideas on how to get the conversation started.

Deciding whether to boost your super, pay down your mortgage, or help your kids out is a common dilemma. We look at some of the considerations to weigh up.

The effects of the pandemic have led to significant increases in life insurance premiums in recent months. We look at what to consider before making any changes to your policy.

Read about some of the key changes to super, tax, and social security measures as the new financial year gets underway.

One way to prepare for uncertainty is to consider and plan for alternative outcomes. We discuss putting higher lending rates and mortgage repayments to the test.

With ESG investing continuing to be on the rise in Australia, we look at potential considerations when thinking about your investment portfolio.

Letting your kids in on money decisions can provide a great opportunity to pass on some money wisdom and learn a few lessons of your own.

Explore the strategies that can help with protecting the value of retirement savings, now and into the future.

When markets go up and down, revisiting the ‘golden rules’ of investing can often help with staying calm and confident.

Just when you thought you’d reached your limit, life throws more unexpected challenges directly in your path. Read on for some tips to get you through a difficult time.

Your money and emotions are interconnected, more than you might realise. Learn some handy tips on how to navigate uncomfortable emotions and make smarter money decisions.

If your saving efforts are feeling sluggish, here are some simple yet effective science-backed ideas to try on for size. One might just work for you.

EOFY is just around the corner. Learn 5 things that may help to reduce your personal income tax and/or provide for your retirement.

Stepping in to help children enter the property market might be a noble thing to do. But it can come with a few risks that are worth being aware of.

Vanessa Stoykov has known billionaires, millionaires, and those who aspire to be—and there are two common denominators that come up time and time again. Find out what they are.

Becoming a master of delayed gratification means you can buy as many marshmallows as you want, forever. Delayed gratification is basically your ability to resist the allure of an instant reward.

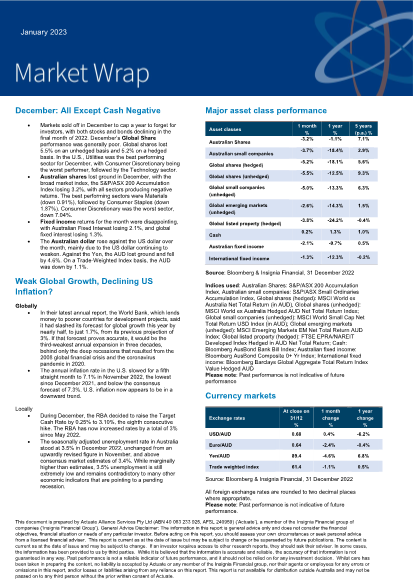

Markets started the year on an extremely positive note. Both stocks and bonds producing significantly above average monthly returns.

Markets sold off in December to cap a year to forget for investors, with both stocks and bonds declining in the final month of 2022.

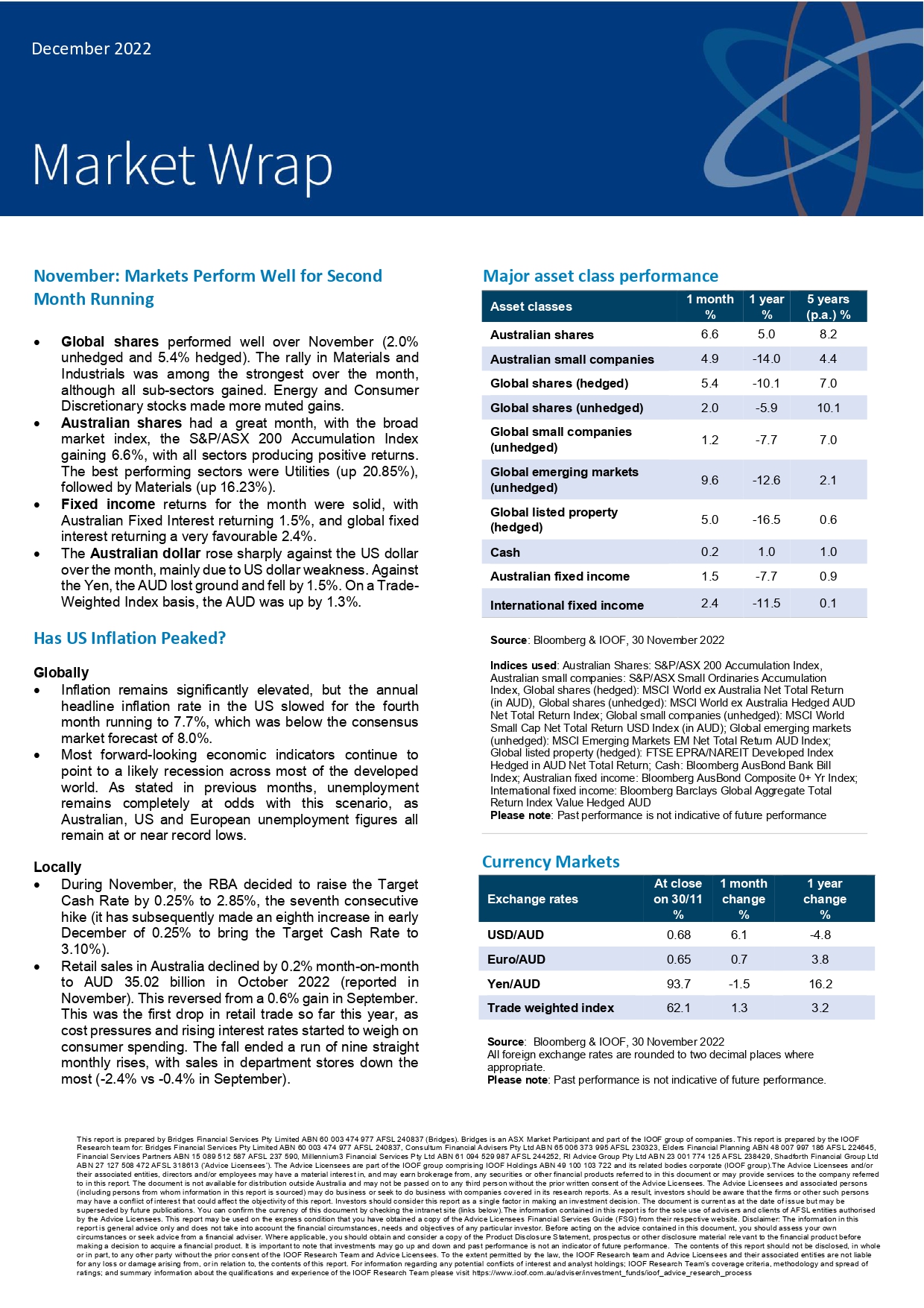

Global shares performed well over November (2.0% unhedged and 5.4% hedged). The rally in Materials and Industrials was among the strongest over the month, although all sub-sectors gained.

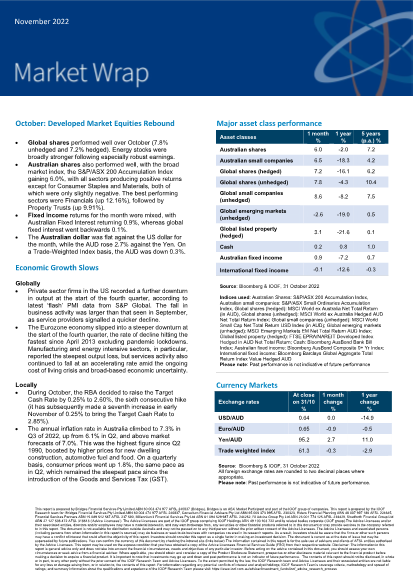

Global shares performed well over October (7.8% unhedged and 7.2% hedged). Energy stocks were broadly stronger following especially robust earnings.

We all like a good cost saving tip, even if it is something we already know. It never hurts to revisit some top tips and take a look at our current situation to see if there are savings to be made.

We spend a lifetime generating wealth but few of us spend the time to ensure it’s passed on in the way we want it to.

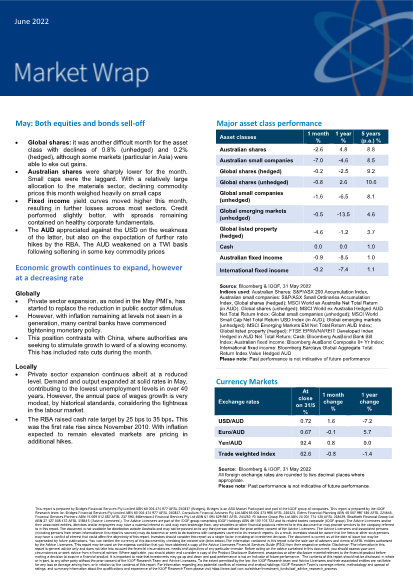

Global shares: it was another difficult month for the asset class with declines of 0.8% (unhedged) and 0.2% (hedged), although some markets (particular in Asia) were able to eke out gains.

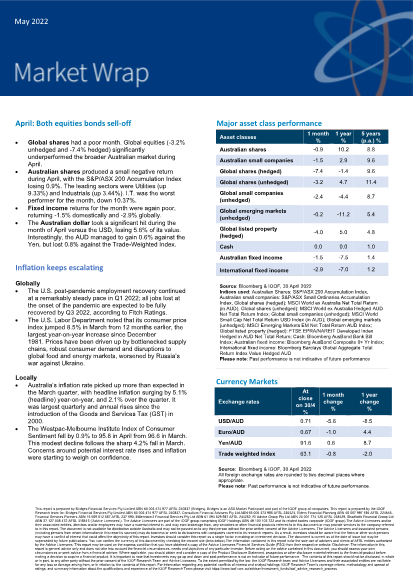

Global shares had a poor month. Global equities (-3.2% unhedged and -7.4% hedged) significantly underperformed the broader Australian market during April.

Planning for a future where super is essential - but only one part of retirement planning – is where financial advice matters. Many people can manage single-focus decisions.

From 1 July 2022, if you’re a first home buyer you can release up to $50,000 (up from $30,000) from your voluntary super contributions to help you buy your first home. Under the scheme, voluntary concessional and non concessional contributions made on or after 1 July 2017 may be released from super to help you purchase your first home.

Imagine if you travelled back 30 years and told your past self how the world would change over the three decades that were to follow.

To be eligible to access super, you must be able to meet a specified condition of release. In this article, we give an overview of the conditions of release—which isn’t limited to ‘attaining age 65’.

Between June and November of 2021, a group of Australians collectively lost an estimated $374,000 to a crypto investment scam. We hear a lot about the highs but there are also many lows.

On 29 March 2022, Treasurer Josh Frydenberg delivered the 2022-23 Federal Budget. We provide an overview of key proposed policy measures that may be relevant to you and your personal finances.

Nominating your super beneficiary is something you have most likely been asked to do if you have a superannuation fund.

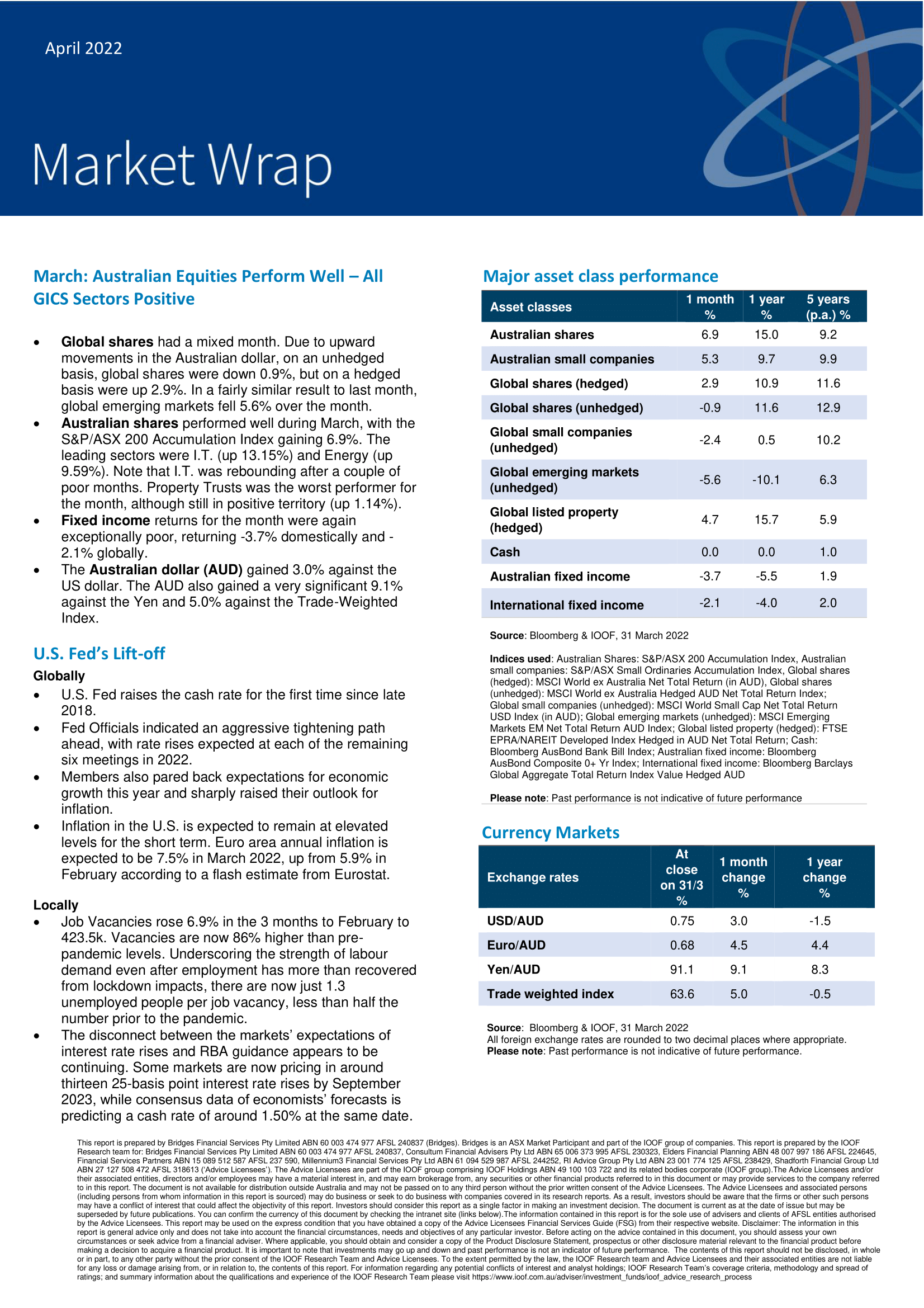

Global shares had a mixed month. Due to upward movements in the Australian dollar, on an unhedged basis, global shares were down 0.9%

The unexpected events of the past few years have made financial protection a front of mind matter for most Australians. Now more than ever we appreciate that life does not always go the way we plan. Having a plan in place if things do take an unexpected turn can mean that our health, lifestyle and family are better protected.

Vanessa Stoykov is a renowned Australian money educator. In this special financial education piece, Vanessa shares five simple questions worth asking yourself that could very well save you thousands.

In the finance industry, there can be a considerable amount of jargon. In this article, we help clarify some of the commonly used jargon within the personal insurance space.

At 30 June 2021, 65% of all SMSFs had a corporate trustee structure—instead of an individual trustee structure. In this article, we discuss SMSF trustee responsibility, eligibility, and structure types.

The Household, Income and Labour Dynamics in Australia (HILDA) Survey collects information on many aspects of life. In this article, we explore retirement trends highlighted in the 2021 HILDA Survey.

Vanessa Stoykov is a renowned Australian money educator. In this special financial education piece, Vanessa explains the benefits of safety nets—and three steps to consider when looking to build one.

“Our future self is the beneficiary or unfortunate inheritor of all our major decisions and daily choices.“ (Ganschow et al., 2021). In this article, we share an exercise on future self-continuity.

If you work casual or part-time, take time out of work, or have ‘lumpy’ income, it can mean periods where no super contributions are made. In this article, we discuss the carry-forward provision.

Many older Australians desire to age in place, though housing and care needs change as people age. In this article, we cover retirees ageing in place—and the concept of a liveable and adaptable home.

Our super—and subsequent retirement income (and outcome)—can be boosted by, among other things, increasing our contributions. In this article, we cover boosting retirement savings with contributions.

Our present habits can often either help or hinder us in our pursuit of achieving our future goals. In this article, we discuss habits, and list 16 key financial habits worth considering for 2022.

When an underwriter assesses the information contained in an individual’s insurance application, the need to take risk-reduction action may be identified. In this article, we discuss revised terms.

When it comes to tax on concessional contributions, some high-income earners may have to pay an additional 15% tax (Division 293 tax). In this article, we provide a brief overview of Division 293 tax.

APRA supervises institutions and promotes financial system stability. In this article, we discuss APRA’s new guidance and direction regarding home loan serviceability and income protection insurance.

Housing (homeownership) is a key factor influencing retirement outcomes—not just financially speaking. In this article, we discuss retirement and several things to consider with regard to housing.

In our retirement years, a time may come when we need to consider aged care services to help with looking after ourselves. In this article, we discuss several different types of aged care services.

For the 2018-19 financial year, 436,952 individuals claimed on average $13,395 in deductions for personal super contributions. In this article, we briefly cover personal deductible contributions.

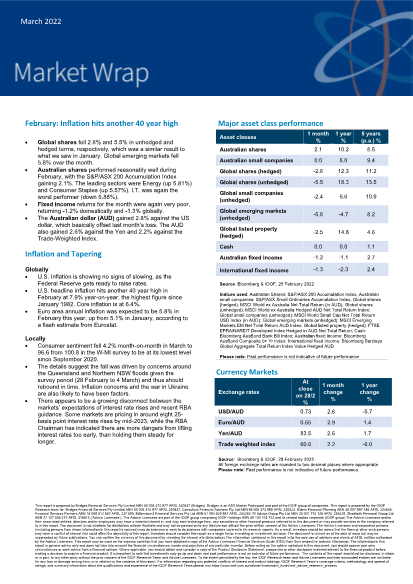

Global shares fell 2.8% and 5.5% in unhedged and hedged terms, respectively, which was a similar result to what we saw in January. Global emerging markets fell 5.8% over the month.

Since July 2018 thousands of people have taken advantage of the Government’s downsizer contribution scheme by selling their home and making contributions to their super.

Are you approaching retirement? Then chances are the funding of your lifestyle in retirement may be on your mind.

Global shares fell 2.2% and 5.1% in unhedged and hedged terms, respectively. Global emerging markets rose 1.2% over the month.

The last couple of years have been tough on a lot of people with the COVID pandemic throwing the world into chaos and taking a toll on our physical, mental, financial and emotional wellbeing.

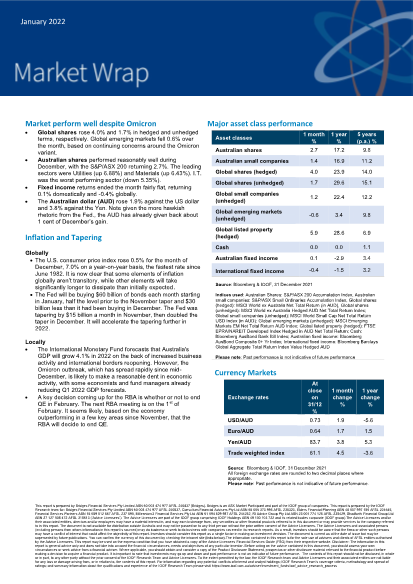

Global shares rose 4.0% and 1.7% in hedged and unhedged terms, respectively. Global emerging markets fell 0.6% over the month, based on continuing concerns around the Omicron variant.

New year is a great time for making lifestyle changes, however, for goals and changes affecting your financial health, there’s often no better time than when starting a new job.

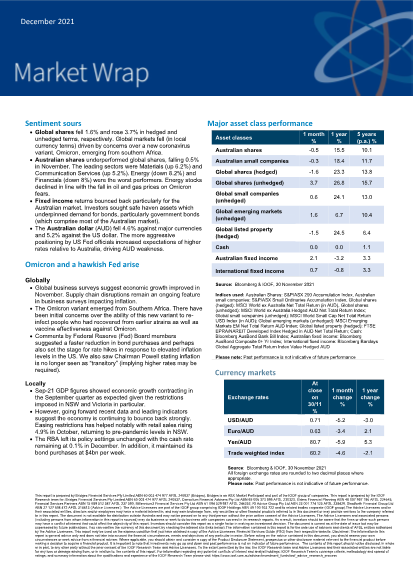

Global shares fell 1.6% and rose 3.7% in hedged and unhedged terms, respectively. Global markets fell (in local currency terms) driven by concerns over a new coronavirus variant, Omicron, emerging from southern Africa.

If you are a small business owner you would know the importance of having a good team behind you.

With a few simple changes, you could set a good example for your children.

Global shares fell 3.8% and 3% in hedged and unhedged terms, respectively.

Taking care of household finances can be time consuming and boring – and often people don’t know where to start.

That means the longer you live, the more money you will need for your retirement. Whatever your plans, it’s vital you have a strategy in place so that you can build your retirement savings as much as you can before you retire.

On 1 July 2021, a new capital gains tax (CGT) exemption was introduced certain granny flat arrangements, making it easier for older Australians to enter formal granny flat arrangements with the added protection from possible financial abuse if circumstances within the family change.

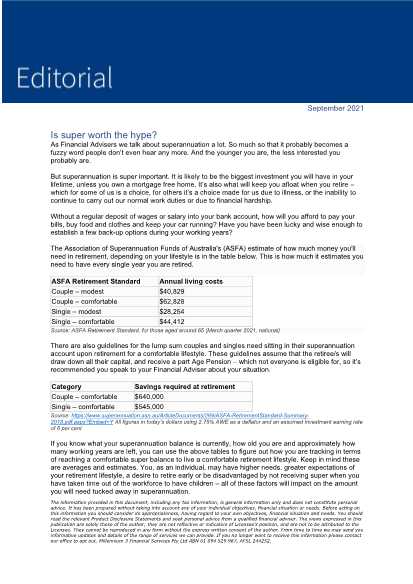

As Financial Advisers we talk about superannuation a lot. So much so that it probably becomes a fuzzy word people don’t even hear any more. And the younger you are, the less interested you probably are.

As Financial Advisers we talk about superannuation a lot. So much so that it probably becomes a fuzzy word people don’t even hear any more. And the younger you are, the less interested you probably are.

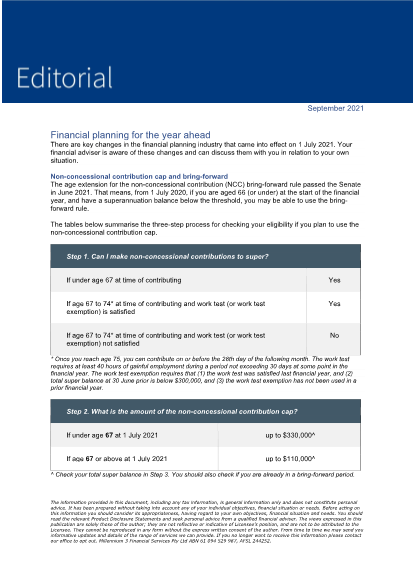

There are key changes in the financial planning industry that came into effect on 1 July 2021. Your financial adviser is aware of these changes and can discuss them with you in relation to your own situation.

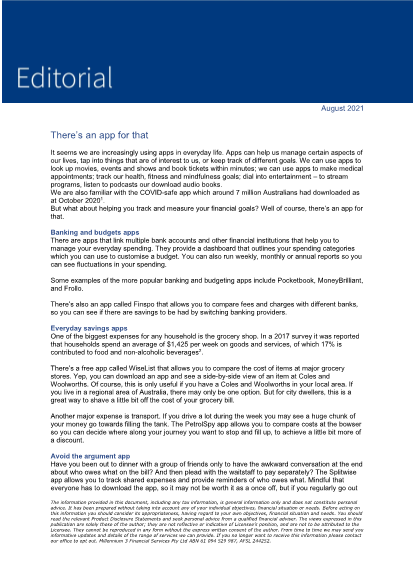

It seems we are increasingly using apps in everyday life. Apps can help us manage certain aspects of our lives, tap into things that are of interest to us, or keep track of different goals.

Compared to other investment structures, super is widely considered to be one of the most tax effective investment structures available from a wealth accumulation and cash flow generation perspective. Although not a comprehensive list, below are 11 of the top tax facts about super.

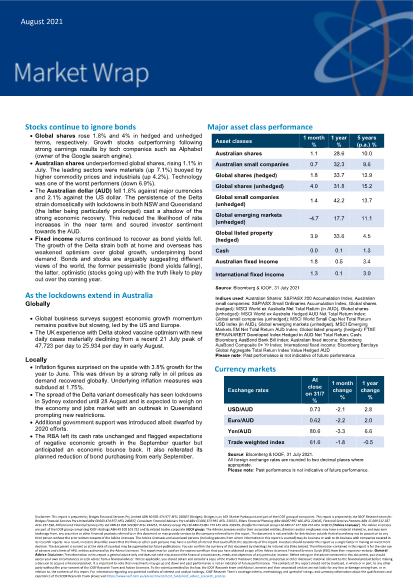

As the lockdowns extend in Australia stocks continue to ignore bonds

The COVID-19 pandemic has been impactful in many ways. For some, it has been a catalyst for reflection and change. In this TED Talk, Simon Sinek covers several quite deep and thought-provoking topics.

An unexpected traumatic event has the potential to have a serious financial impact on you. In this animation, we illustrate specified traumatic events that can be covered by trauma insurance policies.

Vanessa Stoykov is a renowned Australian money educator. In this special financial education piece, Vanessa discusses the concept of life planning and money—and being the author of your own story.

Super is, without a doubt, complex and ever-changing. In this article, we share an important change to super following the recent passing of the ‘Your Future, Your Super’ legislation.

A new financial year can be an opportune time to take stock of your overall personal finances and make changes if needed. In this article, we provide a list of questions that may help you with this.

The commencement of a new financial year can see rates and thresholds increase (or decrease) and legislation take effect. In this article, we provide important information on changes from 1 July 2021.

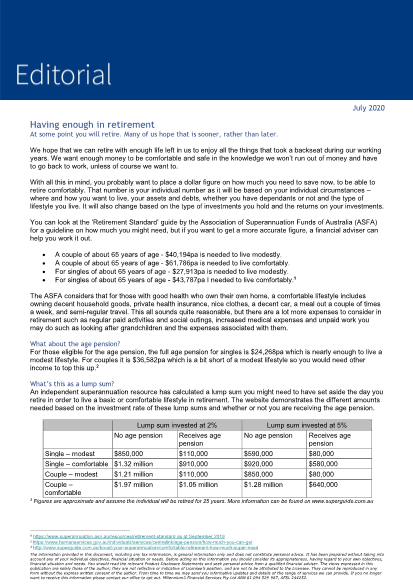

At some point you will retire. Many of us hope that is sooner, rather than later. We hope that we can retire with enough life left in us to enjoy all the things that took a backseat during our working years. We want enough money to be comfortable and safe in the knowledge we won’t run out of money and have to go back to work, unless of course we want to.

Accumulating wealth in super takes, among other things, contributions. However, there are limits to this. In this article, we cover contribution eligibility conditions—maximum age and the work test.

Budgeting is an important foundation block for building and maintaining wealth. In this animation, we illustrate the power that can come from budgeting and putting in place an appropriate budget plan.

Personal insurances can be a key consideration when it comes to wealth accumulation and related health (and financial) risk management strategies. In this article, we summarise the main insurances.

An estimated collective total of $3.9 billion per year is spent on avoidable paid subscription services by Australian households. In this article, we explore spending and paid subscription services.

In 2018, 47% of Australians had one or more of the 10 major chronic disease groups. In this video, the Australian Institute of Health and Welfare (AIHW) briefly covers the health of Australians in 2020.

When it comes to building and maintaining wealth, super is widely considered to be one of the most tax-effective investment structures available.

If you are in, or nearing, the retirement phase of your lifestyle you might be considering whether you want to stay in your current accommodation, or look for something to suit your needs as they change over the coming years.

In a year that has seen so many unexpected events take place it is top of mind for most Australians now more than ever that life does not always go the way we plan, but having a plan in place if things do take an unexpected turn can mean that our health, lifestyle and family are better protected.

In April 2020, underemployment hit a historic high of 13.8%. This Australian Bureau of Statistics (ABS) video covers the impact the COVID-19 pandemic has had on our jobs, industry and the economy.

In April 2020, 1 in 3 household’s finances worsened. This Australian Bureau of Statistics (ABS) video covers the impact the COVID-19 pandemic has had on our health, wellbeing, lifestyle and finances.

From a wealth accumulation and cash flow generation perspective, super is widely considered one of the most tax-effective investment structures. In this article, we cover 11 key tax facts about super.

When it comes to achieving financial wellbeing, financial literacy plays a key role. In this article, we have put together a quiz to test your knowledge across various areas of your personal finances.

We all tend to invest in either one or more of the different types of asset classes to help achieve our financial goals. In this animation, we illustrate the unique characteristics of each asset class.

With 30 June coming up, please consider putting aside time to review your personal finances—and take action, prior to this date, if appropriate. In this article, we provide EOFY planning tips.

Global shares rose 4% and 3.2% in hedged and unhedged terms, respectively. The rotation to stocks benefitting from a strong economic recovery faltered in April. Strong profit results for major US tech companies such as Google saw growth

Treasurer Josh Frydenberg delivered the 2021-22 Federal Budget on 11 May 2021. We provide an overview of several key proposed policy measures that may be relevant to you.

In the 2021-22 Federal Budget, Treasurer Josh Frydenberg announced many proposed policy measures—ABC News’ Leigh Sales interviews the Treasurer to further discuss these proposed policy measures.

ABC News’ James Glenday unpacks the 2021-22 Federal Budget—Australia’s current and forecast economic and fiscal position, as well as the Government’s policy priorities (and proposed policy measures).

The JobKeeper Payment program, which began on 1 March 2020, has now ended (on 28 March 2021). In this article, we provide a status update on several of the other COVID-19 economic response measures.

According to ASFA, the lump sum savings required at retirement for a comfortable lifestyle is $640,000 for a couple. In this article, we cover building super savings together via spouse contributions.

In the finance industry, there can be a considerable amount of jargon. In this article, we help you to understand some of the commonly used jargon in the residential property investing environment.

Whether to keep or sell your home can be a complex decision when looking to enter residential aged care. In this animation, we illustrate the various options, and the potential impact of each on you.

The loss or damage to property due to storms and fire can be devastating. General insurance can help in this regard. In this video, the Bureau of Meteorology explains the recent weather conditions.

The Age Pension remains is a key source of income for many older Australians in retirement. In this article, we discuss the Age Pension and the eligibility tests that need to be met to qualify for it.

Our retirement income—and subsequent retirement outcome—can be affected by how we use our assets. In this animation, we illustrate one option to boost retirement income, the Pension Loans Scheme.

When establishing an insurance policy, it’s important to choose an appropriate ownership structure. In this article, we cover total and permanent disability (TPD) insurance and ownership structures.

The contributions caps limit the amount that can be contributed to super. In this article, we provide details on the future indexation of the contributions caps (concessional and non-concessional).

In June 2020, there were roughly 3.3 million couple families with both partners being employed. In this TED Talk, Jennifer Petriglieri offers guidance on how working couples can support each other.

Aged care is a complex and emotive topic and many people don’t think about their aged care needs until the time to do something is upon them – at which point the options can be limiting. This article explains a couple of the key areas to consider around your aged care plan.

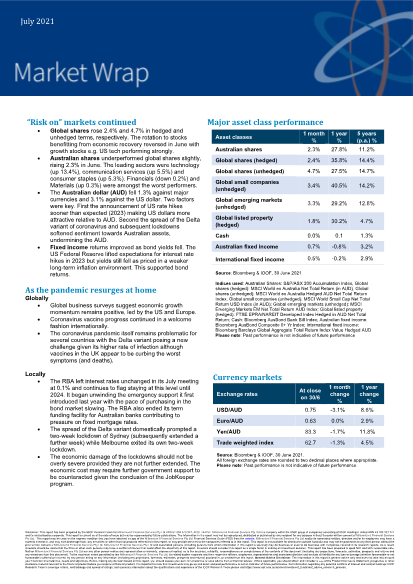

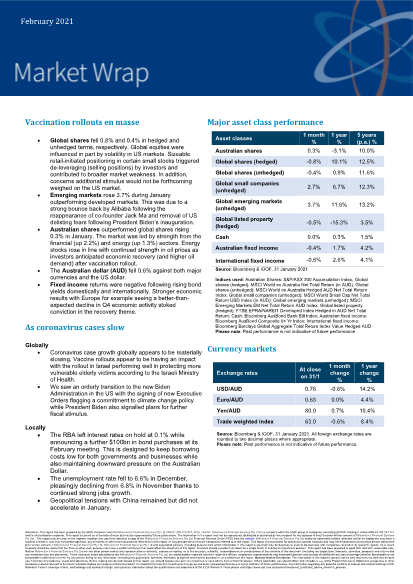

Vaccination rollouts en masse - Global Shares and emerging Markets

The transfer balance cap limits the amount of super benefits that can be transferred to retirement phase. In this article, we provide information on the future indexation of the transfer balance cap.

For some investors, there may be a desire to align their investment values with their personal values. In this animation, we illustrate Environmental, Social & Governance (ESG) investing in detail.

The income you receive will often be assessable for income tax purposes. However, there will also be instances where the tax payable may be reduced. In this article, we discuss several tax offsets.

A number of variables influence the insurance premiums payable on a personal insurance policy. In this article, we cover one such variable, insurance premium style and the options available.

For many, the 2020 calendar year and the COVID-19 pandemic brought about a sudden and dramatic workplace shift. In this Bloomberg video, there are insightful discussions on the future of work.

Have you made a big financial mistake in the past? One that cost you a lot of time and money to fix?

Come retirement, many factors can impact your super balance—such as time coupled with contributions. In this animation, we illustrate the finer details of concessional contributions.

2020 was a year unlike any other in recent memory—testing us financially, physically, mentally, and emotionally over an extended period. In this video, Google showcases searches that shaped 2020.

The making of a resolution can often be sparked post-reflection by our need or want to seek positive change in an area of our life. In this article, we discuss personal finance-related resolutions.

Diversification is a key risk management strategy used when constructing an appropriate investment portfolio. In this article, we provide information on investment portfolios and concentration risk.